Trading manuál | Kontakt | ![]() Česky |

Česky | ![]() English

English

4 THINGS ABOUT GOLD YOU MAY NOT KNOW!

Gold, gold, gold. Yes, sparkling metal moving the world! Is it a great speculative asset, preserver of a value, or an alternative currency? These are the views of us, speculators… Moreover, it has always been a precious metal or a strategic technological resource. What makes gold prices move and how to profit from it? That’s what we should probably be most interested in!

First of All, 4 Things About Gold You May Not Know

This post is about a few interesting curiosities about gold you might haven’t heard of till now. I’ve decided to focus the attention on interesting facts about this yellow metal that play a key role in its trading, and yet many people don’t know much about them. If you use them right, they can inspire you to acquire this pleasant asset… Perhaps a better shortcut for making money is to profit from the price of gold fluctuation than just possessing the thing. But let’s talk about it from the position of demand first – who wants to own gold and why

1. Gold as a technological metal

Gold is a very important metal, not just from the investors’ point of view as a preserver of value. It is also extremely important in industry as technological material. Overall, gold is so valuable, especially because of its wide use for a variety of special purposes. Gold is a very good conductor of electricity, easy to be processed into wires or castings. It can also be very well alloyed with other metals and formed into a variety of structures accurate in detail

Gold has found significant industrial use in electronics. Many devices use very low voltages and currents that may be easily disturbed by very slight oxidation or corrosion. Gold is a very effective conductor, which can easily transmit even a very low level of electric current. For example, you can find a very small amount of gold in every mobile phone, and just as a matter of interest – there certainly are several tons of gold in billions unused mobile phones around the world. That’s why recycling of old appliances is so important.

Another traditional industry, where gold has been used, is healthcare, for example, in the manufacture of dental prostheses, before being replaced by ceramics and other composites. Furthermore, gold is widely used in aviation, surgery and other areas.

Most areas that use gold have only developed in the last two to three decades, and this trend is likely to continue.

What can this mean for us?

Gold is very expensive to be used anywhere other than where it really has no alternative. It is often used only because less expensive metals simply do not have the desired properties for certain use and substitution. Hence, if there is an area where gold is used, it is rarely being replaced by another metal. This gives us a simple rule: the number of areas where gold is used can only grow over time.

Info for Traders: It is clear that increasing demand for gold as a technological metal does not give bears much chance for shorts, but has been pushing up gold prices long-term. This certainly is good to know if we are deciding to sell or buy gold in the long term. Nevertheless, it is necessary to observe the correlations between long-term and medium-term price development charts, which show that gold can get stuck at a lower price for quite a while sometimes! That’s why we perceive gold as particularly suitable for short-term speculations and we go with trend and sentiment. We store gold in the safe for a long-term outlook and we don’t bother with prices; statistically, it only slightly keeps the value above inflation.

2. SPDR Gold Trust – The World’s Largest Fund Investing in Gold

SPDR Gold Trust is the largest gold investment fund and its shares are traded on the stock exchange. This makes it possible to invest in gold, not directly, but through a deposit in the mutual funds of this company.

SPDR is one of the most popular and most liquid ETFs (exchange-traded funds). Its advantage over other forms of indirect investments in gold is its excellent liquidity, which reduces the cost of its trading. One of the reasons why SPDR has such a head start in market capitalization over other funds is the structure of its owners. These are large institutional investment companies, which possess large capital resources and are connected to equally liquid companies.

What To Watch And What Comes Out of it?

there are also relevant reports on the behavior of central banks and governments of countries that sell or buy gold for a variety of reasons. To be honest, you won’t find much logic in it. When politicians and those who influence monetary politics need money for spending, they easily somehow justify the sale of gold reserves. When they feel threatened, they follow investment funds and buy. Politicians and economists are basically silly, they usually are just someone’s employees and have short-term previews and strategies. They are easy to be manipulated by fund managers and wolves from Wall Street.

Info for Traders: These manipulations and mood swings do not usually happen suddenly. For purchases, capital must be accumulated gradually, as well as the sales are organized gradually. You can easily see it in the charts Week, Day… Onsets of the events in the charts 4Hour, Hour… Do not rather try the minute scalping in gold, you won’t beat investment funds in volumes. Simply learn to swim with the flow and be patient!

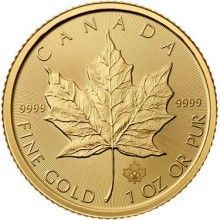

3. The Difference Between Gold Coins And Investment Ingots

There is a difference in investment potential between classic i nvestment bars (which can weigh from one ounce to, for example, 400 Troy ounces) and eg Gold Coins. Investors usually buy gold coins from private dealers, and their price is between 1-5% above the price of the raw gold it contains. The advantages of gold coins are especially that their price is well publicly available in various investment bulletins, etc. and are therefore easily exchangeable.

nvestment bars (which can weigh from one ounce to, for example, 400 Troy ounces) and eg Gold Coins. Investors usually buy gold coins from private dealers, and their price is between 1-5% above the price of the raw gold it contains. The advantages of gold coins are especially that their price is well publicly available in various investment bulletins, etc. and are therefore easily exchangeable.

Coins are usually minted in smaller weights of one ounce or less. This makes them a more affordable investment then, for example, larger gold bars. Besides, coins also have a numismatic and collectable value that changes over time, regardless of the price of the gold metal itself. On the contrary, the value of gold investment ingots and small bars is purely determined by the price of the gold they contain. Bars are therefore more transparent in value and have a more easily identifiable value.

How Does This Pertain to You?

If you have free resources, feel free to invest 5-10% of your capital in gold coins, they have better convertibility. Bars may be easier to store, but they are more difficult to exchange! Keep in mind that buying gold simply preserves the value of assets and money. Speculation on long-term growth is just speculation. In ancient Rome, you could buy a senator’s suit – a Torah, a luxury belt and sandals for an ounce. Today you basically buy the same for this amount of gold…

4. Investing in Gold During the Wedding Season in India

One of the biggest factors affecting the demand for physical gold is the wedding season in India. India is one of the largest consumers of physical gold in the world. The reason for this is traditionally pompous and spectacular wedding ceremonies, which typically take place in January – February.

Wedding celebrations in the traditional season are the source of approximately one-third of the total amount of gold consumed annually in the form of jewellery. About ten million wedding ceremonies take place every year at this time! As a result, the price of gold typically rises before this period.

We are not in India, but we can still open our way to gold, or it’s equivalent in money. It’s not as complicated as you would imagine. Just watch emailing from Goldstarway carefully this week. What can you find in it? Well, information about the new Happy Day, which will be announced next week! It’s easier than gold panning. Just keep an eye on emailing and when you receive it, take the action! But now a few more things about India …

Author’s note:

Update to the information: In the meantime, they have made quite fundamental regulations regarding the sale of gold to eliminate price fluctuations in India. On the other hand, similar shopping frenzies are taking place in China on the Chinese New Year, or in Dubai in February as part of the sale events of everything. They attract millions of buzzing tourists buying gold bars in gold vending machines.

If, for example, industry announces reduced consumption or governments manipulatively trigger light sales because they see a demand somewhere and thus an easy income for spending, then the fundamental impact of all these events causes “investing in gold in the wedding season in India” is being quite successfully eliminated.

Recommendations for Traders: Simply ignore fundamental reports of this type and look at the mid-term Day and 4Hours charts to see where the markets are going! Just between us, price movements on the stock and currency markets, or the mood on “black gold”, have a much greater influence on the price development of gold. If peace, the price of gold drops. If panic, the price goes up. After all, that’s why we are speculators to understand these reports and information so we can profit from them!

And great news at the end: What about improving and leveraging speculations with gold or other assets on the Goldstarway platform with a bonus capital? With how much, how and why – wait a few days… But be alert!

Finally, very soon you will be able to take advantage of the offer of 40-70% extra bonus being added to your deposit

with Goldstarway Happy Day!

Obtain priority information for the capital bonus here:

Click on the picture to obtain the priority information! And once you receive an email with information about Happy Day, don’t hesitate to register! Your bonus will open up great opportunities for improving your money management and calm your trading nerves.

I’m sure it’s worth it!

Daniel Bergmann